Key Takeaways

Bottom Line Up Front: Meridian Contrarian Fund demonstrated classic contrarian behavior in Q1 2025, trimming winners while adding to beaten-down value plays during a challenging quarter that saw small-caps enter bear market territory. The fund's -7.59% return slightly underperformed the Russell 2500 Index (-7.50%) but showcased disciplined portfolio management through strategic position sizing and sector rotation.

Market Context: A Perfect Storm for Small-Caps

Q1 2025 proved to be a brutal quarter for small-cap investors, with the Russell 2000 Index becoming the first major U.S. stock measure to enter bear market territory. Small-cap stocks, which were once thought to be primary beneficiaries of President Donald Trump's policies, entered bear market territory on Thursday amid a massive stock market rout that followed the administration's sweeping and aggressive tariff rollout.

The Meridian Contrarian Fund, managed by ArrowMark Partners, faced these headwinds head-on, returning -7.59% (net) during the quarter, as noted in their recent investor letter. U.S. equities saw their weakest quarterly performance since 2022, as uncertainty about potential tariff policies affected investor sentiment and risk assets.

Portfolio Overview: Concentrated Conviction

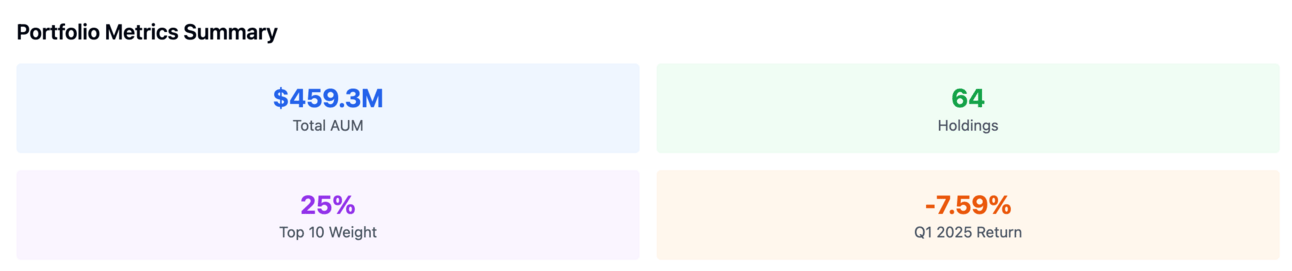

As of March 31, 2025, the Meridian Contrarian Fund managed $459.3 million across 64 holdings, reflecting a focused approach to value investing. The portfolio's concentration in its top positions demonstrates management's conviction-weighted strategy:

Top 10 Holdings: Represent approximately 25% of total assets

Average Position Size: Roughly 1.6% of portfolio

Largest Position: AXIS Capital Holdings (AXS) at 4.21% of portfolio

Strategic Moves: The Art of Contrarian Timing

Major Portfolio Additions: Opportunistic Value Hunting

The fund's Q1 2025 activity revealed a clear pattern of adding to positions during market weakness:

Nexgen Energy (NXE) - Added 125.32% (269,000 shares)

Nuclear uranium play capitalizing on AI data center power demands

Portfolio weight increased to 0.47%

SpringWorks Therapeutics (SWTX) - Added 44.09% (41,000 shares)

Biotech specializing in oncology treatments

Strong pipeline momentum despite broader biotech selloff

Zenas BioPharma (ZBIO) - Added 32.64% (60,000 shares)

Immunology-focused biotech with promising late-stage assets

Complete Portfolio Exits: Profit-Taking Discipline

The fund completely sold out of seven positions, realizing gains after strong performance:

Cars.com (CARS) - Sold 100% (475,000 shares)

Auto marketplace showing strong margin recovery

2024 revenue of $719M with improving profitability

APA Corporation (APA) - Sold 100% (302,125 shares)

Energy producer benefiting from commodity price strength

ACV Auctions (ACVA) - Sold 100% (287,000 shares)

Digital automotive auction platform

Investment Thesis Deep Dive

Financial Services Overweight: Banking on Recovery

The fund maintains significant exposure to financial services, with top holdings including:

AXIS Capital Holdings (AXS) - 4.21% of portfolio

Investment Rationale: We invested in 2020 following a period of earnings pressure tied to unfavorable underwriting results. We were initially attracted by a new management team's operational turnaround efforts, including reduced exposure to catastrophe risk and a strategic focus on high-potential areas such as cyber insurance.

Financial Metrics:

ROIC improvement to 15.1% in 2024 (vs 5.8% in 2023)

Strong FCF generation of $1.85B in 2024

Trading at attractive 10.1x P/E ratio

First Citizens BancShares (FCNCA) - 3.82% of portfolio

Regional banking powerhouse with exceptional profitability

Net margin of 28.5% in 2024

Strong ROIC of 4.7% despite challenging rate environment

Book value trading discount at 1.14x P/B

Energy Sector Bet: Nuclear Renaissance

Cameco Corporation (CCJ) - 3.10% of portfolio The fund's continued conviction in nuclear energy reflects long-term structural themes:

Cameco Corporation (NYSE:CCJ) is a global leader in the mining, fabrication, and refinement of uranium products for nuclear power plants around the world. We view the company as a best-in-class operator with world-leading reserves and a low-cost profile.

Revenue Recovery: $2.2B in 2024 (up from $1.9B in 2023)

Margin Expansion: Net margin improved to 5.5% in 2024

AI Data Center Demand: Nuclear power increasingly viewed as clean baseload power solution

Value-Oriented Metrics Analysis

The fund's holdings demonstrate classic value characteristics:

Return on Invested Capital (ROIC) Focus:

AXS: 15.1% (excellent for insurance)

FCNCA: 4.7% (solid for banking)

CCJ: 2.1% (improving trend)

Free Cash Flow Generation:

AXS: $1.85B (strong and growing)

FCNCA: $1.70B (consistent generator)

CCJ: $487M (recovery mode)

Valuation Metrics:

Portfolio trades at reasonable multiples despite quality bias

Focus on P/FCF and EV/FCF ratios for cash-generative businesses

Emphasis on companies with net cash or manageable debt levels

Contrarian Philosophy in Action

The Meridian Contrarian Fund's Q1 2025 activity exemplifies several key contrarian principles:

Counter-Cyclical Positioning: Adding to energy and biotech during sector weakness

Profit Realization: Trimming/selling winners like Cars.com and APA Corp after strong runs

Quality at Reasonable Prices: Focusing on companies with improving fundamentals despite market pessimism

Long-Term Perspective: Maintaining conviction in structural themes (nuclear energy, specialty insurance)

Sector Allocation Insights

Based on the holdings analysis, the fund maintains diversified exposure with notable concentrations in:

Financial Services: ~15-20% (Insurance, banking, asset management)

Healthcare/Biotech: ~10-15% (Opportunistic additions during Q1)

Energy: ~8-12% (Nuclear and traditional energy exposure)

Technology: ~5-10% (Selective positions in beaten-down names)

Consumer: ~5-8% (Defensive and cyclical plays)

Risk Management Through Position Sizing

The fund's approach to position sizing reveals sophisticated risk management:

Largest positions (3-4%): High-conviction, quality companies (AXS, FCNCA, CCJ)

Medium positions (1-3%): Core holdings with balanced risk/reward

Small positions (<1%): Opportunistic bets and new positions

Looking Ahead: Positioning for Recovery

Amid rising volatility, the index posted a notable gain through February 19, but then sharply reversed course and fell solidly into negative territory by the end of the quarter, particularly dragged down by growth stocks and smaller-caps.

The fund appears well-positioned for potential small-cap recovery, with exposure to:

Interest Rate Beneficiaries: Financial services companies that benefit from rate cuts

Structural Growth Stories: Nuclear energy and specialized insurance

Cyclical Recovery Plays: Companies positioned for economic reacceleration

Quality at Discount: High-ROIC businesses trading at attractive valuations

Conclusion: Patient Capital Allocation

Meridian Contrarian Fund's Q1 2025 performance demonstrates the patient, disciplined approach that defines successful contrarian investing. While the fund slightly underperformed its benchmark during a challenging quarter, the strategic moves—adding to quality companies during weakness while trimming winners—position the portfolio for potential outperformance during any market recovery.

The fund's focus on high-ROIC businesses, strong free cash flow generation, and reasonable valuations aligns perfectly with the current market environment where quality and profitability are being rewarded over growth-at-any-price stories.

Portfolio data as of March 31, 2025. Past performance does not guarantee future results. This analysis is for informational purposes only and should not be considered investment advice.